Businessman, Hamis Kiggundu through his Lawyers of Muwema and Company Advocates led by Counsel Fred Muwema have petitioned Court to dismiss the defence evidence filed by Diamond Trust Bank in a suit filed by Ham accusing the bank of illegally deducting over Shs120bn from his accounts.

The Commercial Court in Kampala had sat on Monday to commence hearing of the case were Ham through his lawyers raised preliminary objection which court ruled that should be determined first.

Hams lawyers argued that the defence filed by Diamond Trust Bank is based on illegalities and should thus be struck out by Court.

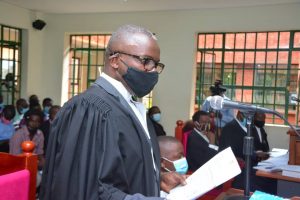

The defences are based on illegal transactions including the loan agreements which were made in Kenya lending in Uganda. DTB Uganda facilitated an illegality by allowing DTB Kenya to break the law in Uganda, Muwema argued.

Muwema told Court that DTB Kenya is not licensed to carry out financial services in Uganda adding that it was wrong to carry out any business with Hamis Kiggundu and later use their counterparts of DTB Uganda to help them enforce the loan agreement in Uganda.

Court thus asked the two parties to file written applications noting that it will offer its judgment on the application on October 5, 2020.

Muwema said that if their application is successful in an October 5, 2020 ruling by the trial judge, Henry Peter Adonyo, there will not be need for any further hearing of the case.

According to court documents, Kiggundu provided security/mortgage comprised in Plot no.923, Block 9 located at Makerere Hill Road to support the credit facilities he had got from DTB but the businessman says when he carried out an audit and reconciliation of the loan accounts, he found out that the DTB had taken shs34 billion and $23 million from his account.

The businessman wants court to declare that DTB breached the different loan agreements entered into with him between February 16, 2011, and November 16, 2019 when it fully recovered over and above what was due to it through the loan installments and interest payment deductions.

In its defence, DTB argues that the businessman through his two companies obtained credit facilities from them and provided securities in the form of property to secure the credit facilities.

The bank argues that the facility agreements entered into between the parties are legally binding and enforceable under the law and that the deductions and charges made against the plaintiffs accounts were in accordance with the credit facilities issued to them.